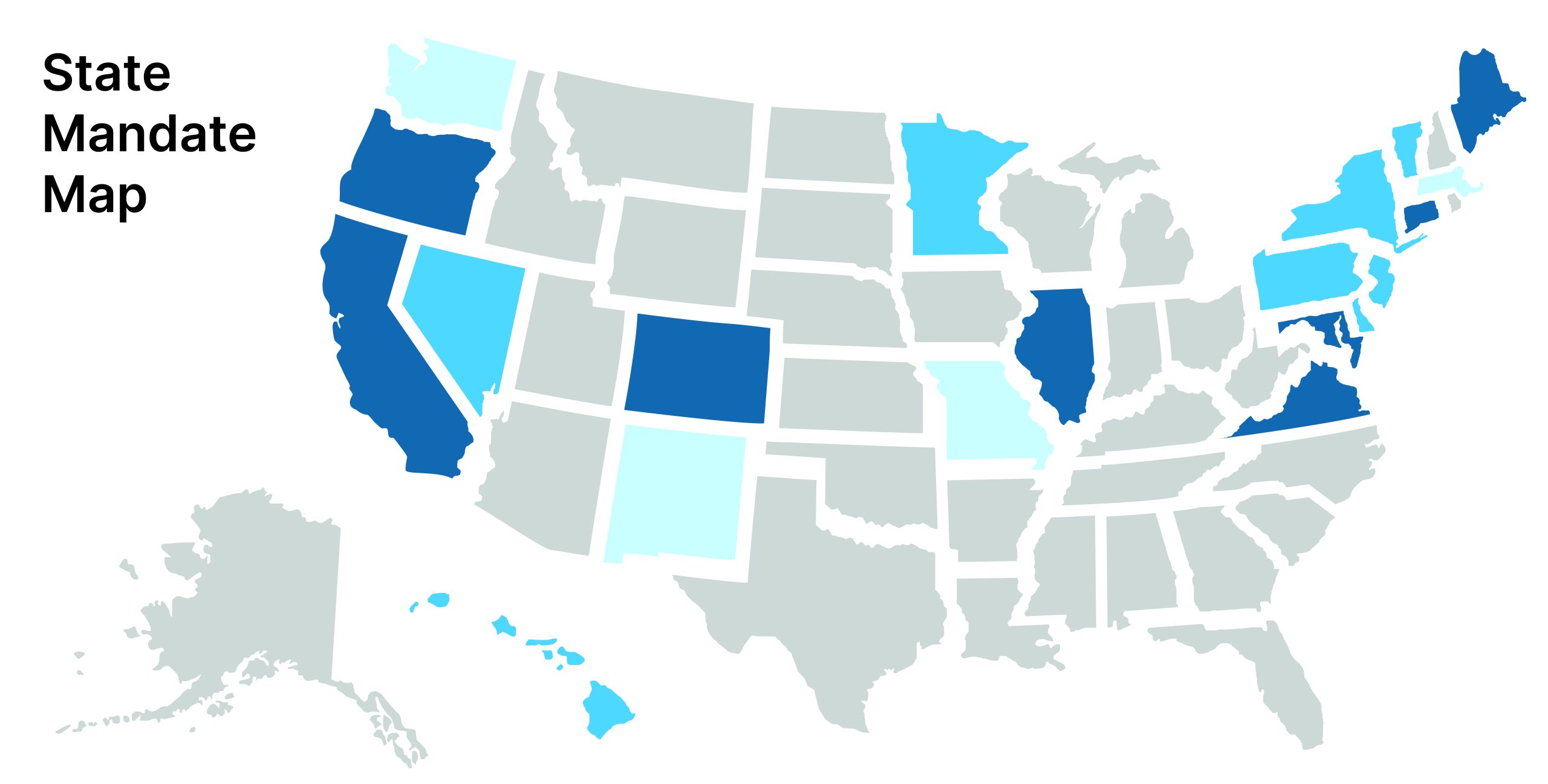

Several states require that employers meeting certain standards offer their employees retirement savings benefits. Here, you can learn which states these mandates apply to.

Let our experts show you how 401GO offers a far superior alternative to state-provided options.

State Mandates

Learn Your Alternatives

Although the details vary from state to state, most are requiring businesses with 5 employees or more to offer a retirement benefit to their employees.

Businesses can choose to use the state-managed program, which is usually a payroll-deduction Roth IRA, or purchase a qualifying alternative privately. Either way, a decision must be made that affects employees.

About half of affected businesses are choosing a private option, and among those that use the state plans, many later change their minds.

The retirement landscape has changed drastically for small businesses, and most can afford a much better benefit than they imagined. Take a look at the details for your state and compare it to the 401GO alternative.

California

Active plan, final deadline 12/31/2025. Download Comparison

Colorado

Active plan, all deadlines have passed. Download Comparison

Connecticut

Active plan, add deadlines have passed. Download Comparison

Delaware

Active plan, launched July 1, 2024. Download Comparison

Hawaii

Legislation signed. Opt-in (not auto-enroll) for employees. Expected to launch July 2024.

Illinois

Active plan, final deadline 11/2023. Download Comparison

Maine

Active plan, final deadline 4/2024. Plan to partner with Colorado in the future. Download Comparison

Maryland

Active plan, no deadlines established. Download Comparison

Massachusetts

Active, voluntary MEP for non-profits only.

Minnesota

Legislation signed, launch date expected in 2024 or 2025.

Missouri

Voluntary MEP, expected to launch September 2025.

Nevada

Legislation passed, expected to launch July 1, 2025.

New Jersey

Active plan, final deadline 11/2024.

New Mexico

Active, voluntary plan. Partnership with Colorado expected to launch July 2024, will still be voluntary.

New York

Plan was expected to launch in 2022, but it is not live yet and no deadlines have been established. Download Comparison

Oregon

Active plan, all deadlines have passed. Download Comparison

Pennsylvania

Legislation passed, waiting to be signed. Expected to launch 2025.

Rhode Island

Legislation signed, launch date not announced.

Vermont

Legislation signed, expected to launch 2025.

Virginia

Active plan for businesses with 25+ employees, deadline 2/15/2024. Download Comparison

Washington

Currently offering a voluntary marketplace; will institue mandates like other states. Legislation signed, with a program to launch January 2027.

State Mandates

Download the free guide to secure choice retirement plans.

With secure choice plans being offered in more and more states, it’s important for businesses to understand enough details to make an informed decision. Retirement plan decisions can have far-reaching consequences for both employer and employee.

State mandated retirement plans are typically Roth IRAs, which have different rules and regulations than 401(k) plans.

Plan designs and mandates vary from state to state, but most have some basic similarities that will help you make a smart choice.

This guide will help you know what to consider when choosing a retirement benefit.

Client Testimonials

See What Our Clients Say

Frequently Asked Questions

Questions? We’ve Got Answers

Is it legally required in all U.S. states for employers to provide retirement plans to employees?

In most states, employers are not required to offer retirement plans. However, a few states do have these requirements, and several more are working on legislation. See the list above for details.

What counts as an employer retirement plan?

While 401(k)s are the most common employer-sponsored retirement plan, other options include SIMPLE IRA plans, SEP plans, profit-sharing plans, cash-balance plans, and stock ownership plans. Each state has rules about what types of plans will count as an exemption from the state plan, so it’s best to consult your state regulations.

Do employees like the state plans?

Obviously, opinions vary. A payroll-deduction IRA is more powerful than a private IRA, and both of those are better than no retirement option at all. However, many bad reviews of the state plans can be found, and most of them focus on communication and education issues and poor support.

By contrast, 401GO has a 4.8-star rating and leads the industry for customer support.

Do employees have to participate in state plans?

Most states offer auto-enrollment IRA plans, meaning employees will be automatically added to the plan, and contributions will be taken from their paychecks. However, employees are always able to opt out of the plan, and stop and start contributions anytime.

Many 401(k) plans also have auto-enrollment features, always with the ability to opt out, so education and communication with employees is important.

What are the penalties for not offing a retirement plan?

These penalties vary from state to state. Those states that have mandates in place will almost always have penalties attached for those who don’t comply. It’s best to consult your state to determine the exact penalties and deadlines.

News and Blog Articles

See Our Recent Blog Posts

Let’s Get Started

Start Your Journey with 401GO

401GO offers 401(k) retirement savings plans that are far superior to state mandate options. How much better? Find out for yourself by beginning the plan setup process right now.