Each year, the government decides how much money you’re allowed to save in a 401(k) for retirement. Historically, this number goes up, partly due to inflation and partly due to other factors. And although the number is usually expected to go up, it doesn’t always go up by the same amount. For our purposes, we don’t need to get into why here. We will just talk about how the numbers are changing and what it will mean for you, your business and your employees.

The New Limits

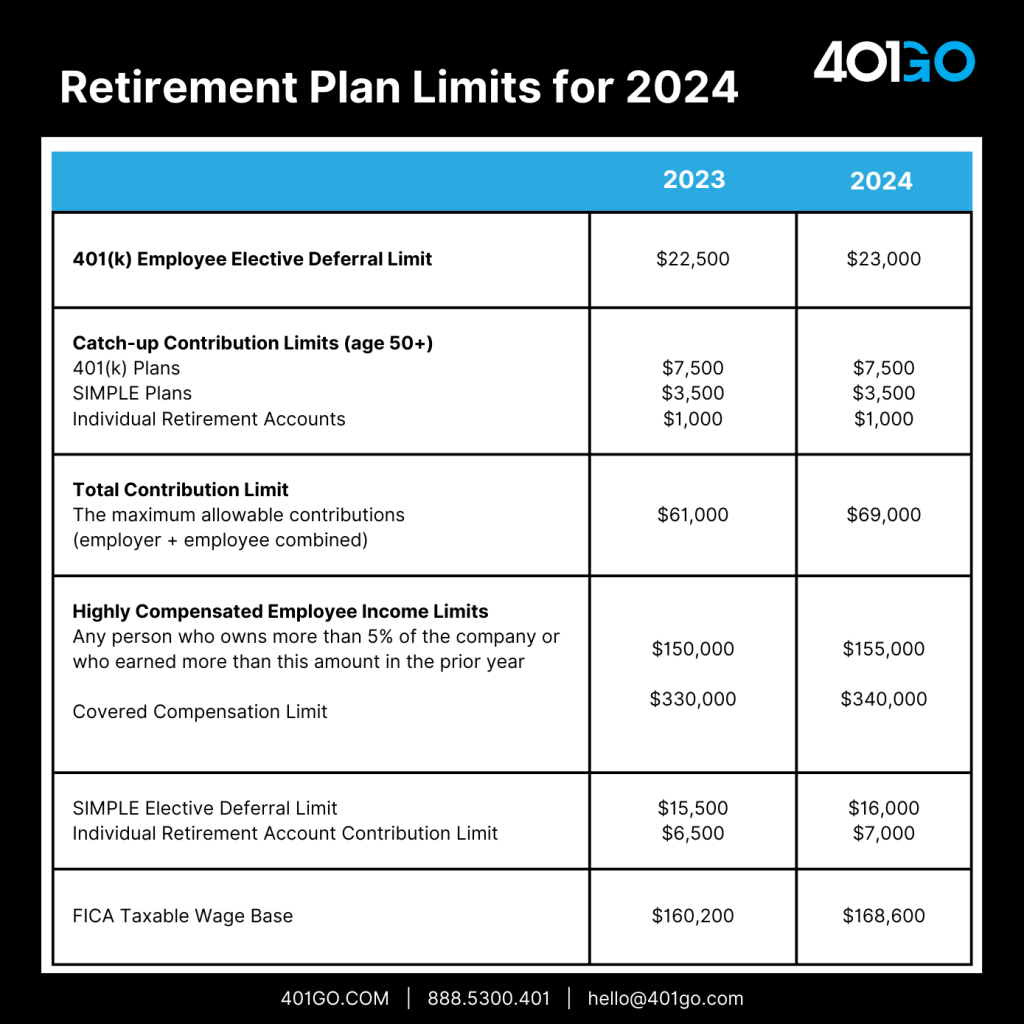

Employees may not put more than the allowed amount into their 401(k) in any given year. In 2023, the elective deferral limit for employees was $22,500; this year, that limit is rising $500 to $23,000.

Many employers offer a match of 50% up to 6% of employee contributions, although these percentages vary with each plan. If you offer the same match at your business and your employee earns $100,000 and contributes 6% ($6,000), you contribute $3,000 for a total of $9,000. These numbers are well below the new IRS limits, but employees have a number of options for reaching these higher maximums for saving.

Download a PDF version of the 2024 Retirement Plan Limits chart.

How to Save More

Many employees may elect to save more than 6% of their income. The first 6% is important because of the company match. Employees unable or unwilling to save at least 6% are essentially missing out on free money. If we use the employee earning $100K as an example, and that employee earmarks 3% deferral rather than 6%, they are missing out on a full $1,500 from the company.

Some employees legitimately can’t afford to contribute the full 6% due to debts, living expenses or other obligations, but many simply don’t realize they can do more to help themselves. In fact, according to a CNBC Money Survey, nearly half of people who contribute to a 401(k) say that they do not contribute the maximum because they can’t afford to.

Those who can afford it may contribute 10% or more — as long as they don’t exceed the maximum of $23,000. To be clear, this maximum is the employee maximum. The employer match doesn’t count toward this number. The government sets a separate maximum for combined employee + employer contributions. In 2023, it was $61,000; this year, it’s $69,000.

Because different companies may contribute different matches, the important part of this equation is not so much the percentage, but the total contribution.

Highly Compensated Employees

Employers must keep in mind, however, that although employees are allowed to contribute more than 6%, care must be taken to not violate the laws with respect to highly compensated employees. Part of the reason the IRS has rules governing how much employees can save is because the government is trying to limit the advantage that highly compensated employees would have if everyone was allowed to contribute however much they wanted.

Therefore, you may have to limit some of your employees’ contributions if they are among your more highly compensated workers. IRS rules define highly compensated employees as those who own more than 5% of the company or who earn over a certain dollar amount. Last year, the limit to qualify as a highly compensated employee was $150,000; this year, it is $155,000.

It gets complicated, however, with rules regarding which employees are and are not in the top 20% of earners, and how much the average earner is contributing. This is why some companies opt to open a Safe Harbor 401(k), which exempts them from compliance audits that identify, among other things, whether HCEs are getting an advantage. In exchange for this get-out-of-jail-free card, they are obliged to adhere to other rules such as making mandatory matching contributions.

Catchup Contributions

Whether you offer (or plan to offer) a traditional 401(k) or a Safe Harbor 401(k) at your company, employees 50 and older are allowed to make catchup contributions, so called because they allow workers who are closer to retirement but may have not saved an adequate amount to “catch up.” The limits for 2023 have remained the same for 2024 — $7,500 per employee.

How These Changes Affect Business

The bump in limits each year may impact the bottom line of some companies more than others. Hypothetically, if you did not give anyone at your company a raise, your employer matching contributions would not go up (unless more of your employees qualified as eligible, or more eligible employees opted into the plan). If you gave everyone a big raise, however, your costs might go up significantly. Other factors affecting the equation include if you gave some people raises but not others, if you hired or laid off a consequential number of employees or if you changed your matching percentage.

While your budget and how your company runs are likely your most important concerns, it is further useful to examine how you may be able to help and advise your employees regarding saving for retirement.

Although 68% of U.S. workers have the option to contribute to a 401(k) plan, many of them do not. Whether this is due to personal choice, ignorance or financial concerns is unclear. Further, these percentages fall when the pool is limited to small businesses. Many fewer small businesses offer a 401(k) plan, which was the impetus for kickstarting 401GO. The time, effort and expense of starting at 401(k) can ice out small-business owners, and our aim was to give this segment of the economic population a viable option. Some state governments have followed suit by implementing mandates that employers offer employees access to an IRA, which is better than nothing, but not in the same league as a 401(k).

The fact that you, a small-business owner, are reading this means that you either sponsor a 401(k) plan for your employees or you are considering doing so in the future. Your goals may be business-oriented — you want the best employees and offering good benefits is the way to get them — but you are also helping people get better financial footing by constructing a safety net that can help protect them in their later years.

Ready to help your business grow and improve your employees’ lives by partnering with 401GO? Get started today.