The state of Connecticut created a retirement security program in 2016. Like many other similar state retirement programs, it mandates that all employers that do not offer a retirement plan to their employees participate in the state plan.

Employers who will fall under the mandates in the coming year may wonder whether this plan or an alternative is the best choice for them.

The Retirement Problem in Connecticut

It’s estimated that almost 600,000 workers in Connecticut do not have access to a work-sponsored retirement plan. With increased reliance on social services, which is ill-equipped to provide a comfortable living, it’s important to help employees become more involved in their own retirement planning.

My CTSavings is patterned after other successful programs here in the U.S. It’s intended to provide a savings option for those who don’t already have one, not as a replacement for existing retirement plans.

My CTSavings: The Details

This program, like several others, is essentially a payroll-deduction Roth IRA. It is for both for-profit and non-profit companies that have at least 5 employees who received at least $5000 in wages during the previous year, and do not already offer a retirement plan.

The accounts essentially belong to the employee, and can move with them from job to job, with no need for a rollover or other change.

Employees are automatically enrolled in the plan, at a default contribution rate of 3% of gross income. Participants can opt out, or they can change their contribution level any time.

The program is available at no fee to employers, and they have no fiduciary or plan management responsibility. The employer is also barred from contributing to employees accounts. Their only obligation is to enroll, and to facilitate the payroll deduction.

Employer Compliance Timeline

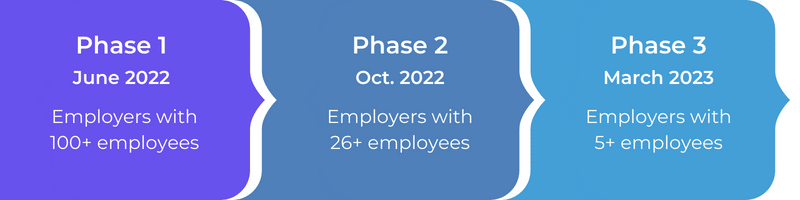

My CTSavings has three waves of implementation scheduled.

- Wave 1: June 2022 for 100+ employees

- Wave 2: October 2022 for 26+ employees

- Wave 3: March 2023 for 5+ employees

The Dark Side of Secure Choice

The benefits of the Connecticut program are clear: no cost and no liability for employers means the main barriers to work-provided retirement planning are removed. A closer look reveals some potential downsides.

1) Income Limits: If employees earn too much, they are not eligible for the program. It’s also not an effective vehicle for those who are close to retirement.

2) Contribution Limits: Far lower than a 401(k), Roth IRAs only allow contributions of $6,500/yr (2023). If an employee has an additional private IRA, they’ll need to track these limits themselves, and take care not to over-contribute.

3) No Matching: Employers are barred from making matching contributions to employee accounts.

4) No Protection: The Connecticut program is not subject to worker protections under ERISA, which requires fiduciary oversight, plan information to be provided to participants, and the establishment of a grievance and appeals process.

5) No Tax Benefit for Employees: Since Roth IRA contributions are made post-tax, workers looking for more immediate tax benefits will not get them. By contrast, 401(k) plans offer both pre- and post-tax contributions.

6) Poor Investment Options: The selection of investments available to Connecticut employees may not be suitable for everyone. The default selection places funds in a money market for 60 days, and then into an age-appropriate target retirement date portfolio. Other retirement vehicles may have an investment lineup that is more robust and effective for wealth building.

The Best Alternative to Secure Choice: a 401(k)

Employers may find a 401(k) to be a better option for their business than the state-mandated program for several reasons. Most of these reasons are apparent when the downsides of secure choice programs are clearly understood, but three main benefits stand out.

1) Tax Benefits: Implementing a new 401(k) plan can potentially qualify an employer for up to $5000/yr in tax credits for 3 years. And, matching contributions are usually tax deductible. Many employers find they prefer to give the money to employees rather than spend it in taxes.

2) Employee Retention: A surprisingly high percentage of employees would rather receive additional benefits than a pay raise, and more than half consider benefits when deciding whether to accept a new job.

3) Less Burdensome than in the Past: Especially for small businesses, traditional 401(k) plans have been expensive, complicated, and come with excessive liability. New platforms like 401GO provide employers with an option that is inexpensive, unbelievably fast, and very low in administrative burdens and fiduciary liability.

Understand the Options

New platforms like 401GO are becoming available now that give smaller employers flexibility and freedom that they never had access to before. For less than the cost of a gym membership, a business owner can give workers a robust 401(k) plan that levels the playing field and lets them compete in the labor marketplace.

Consider these features:

- Automated setup takes just minutes, not weeks.

- Automated administration, compliance, and payroll integration require almost no time from employers and eliminate worries.

- The easy-to-use platform gives participants easy account access, increased control and hundreds of investment options.

- Live, world-class customer support is available to both employers and employees.

- Plan flexibility allows employers to add the components that meet their needs.

- The financial wellness tool helps users make wise financial choices and build their wealth.

- 401GO serves as the fiduciary, the administrator and the recordkeeper, removing these worries from business owners.

- If you currently use a financial advisor, the advisor can partner with 401GO to help manage your plan.

- At just $9/user/month with no setup fees, 401GO is much more affordable than competitor plans.

Ask for more information, become a partner, or start a plan today.