Although life expectancy in the U.S. peaked in 2014 at 78.9 years, many of us are living much longer, and it costs money. The government is making less noise than it used to about ending Social Security, but few people are able to live on that alone, assuming that it lasts past 2034. So the future is all about 401(k)s and IRAs now.

The problem is that only about a third of working Americans have any type of retirement account, partly because many work at small businesses that don’t offer them. For this reason, many state governments have created retirement programs that businesses are invited — or required — to participate in. If you’re a small-business owner, you need to know if your state has a mandate and if it does, what you need to do to comply.

States That Have Retirement Plans

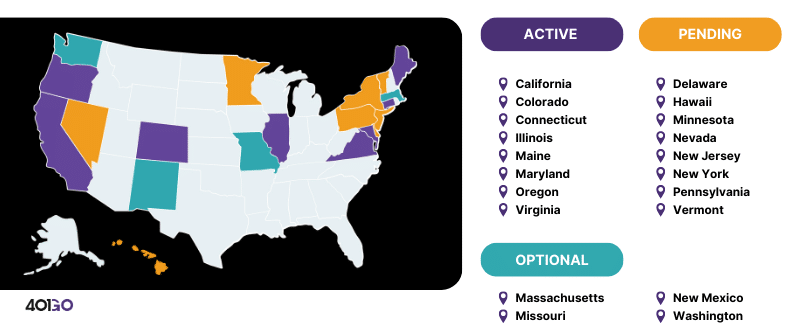

As of this writing, 20 states (and two cities — New York and Seattle) have passed legislation to establish retirement plans. They are:

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Illinois

- Maine

- Maryland

- Massachusetts*

- Minnesota

- Missouri*

- Nevada

- New Jersey

- New Mexico*

- New York

- Oregon

- Vermont

- Virginia

- Washington*

But many more states are in the process of legislating retirement plans, so if you think you don’t need to worry about it, you’re probably wrong.

Each state has its own rules, and if you operate a business in one of them, it’s important you know what the rules are and follow them, to avoid unpleasantness such as fines and penalties. Below is an FAQ based on the types of questions we’re hearing from small-business owners like you.

Wait, is it even mandated?

Some states with retirement plans targeted to employees of small businesses are voluntary (that’s what the asterisk is for in the list above), not mandated. So of course, there are no penalties associated with failing to implement these programs. Instead, they are meant to provide an easy — and free! — way for small-business owners to provide a worthwhile benefit to their employees.

How many eligible employees trigger the mandate?

For small businesses to be required to participate, they usually must have a minimum number of employees, and this number is often five. This minimum number is slated to change, however, in some states, like California, where it goes down to one eligible employee in 2025, and Oregon, a state with a phase-in with no fewer than six stages of varying requirements. So you need to understand not only what the rules are right now, but what they’re going to be next year and each year after that.

Some states have other requirements outside of employee headcount, such as how long your business has been operating and whether you use an automated payroll system.

What type of plan is mandated or available?

Each state has its own plan with its own name — CalSavers, Colorado Secure Savings Program, OregonSaves, etc. While a couple states offer MEPs (group 401(k) plan), the vast majority are Roth IRAs.

[Sidebar: What is the difference between a traditional IRA and a Roth IRA? Roth IRAs are funded with after-tax dollars, while traditional IRAs are funded with pre-tax dollars. This means if an employee has a Roth IRA, they will not need to pay taxes on their retirement income once they start drawing on it. But if they have a traditional IRA, they will pay taxes on each withdrawal. It sounds like a choice of pay now or pay later, and it is, but the idea behind being able to make this choice is that if you start a Roth IRA when you are young (and presumably in a lower tax bracket), less of your retirement income will be eaten up by taxes than if you paid them later, upon retirement, when you would likely be in a higher tax bracket.]

What is a qualified private retirement plan?

Many states allow you to operate a qualified private retirement plan in lieu of using their plan. You must have your plan up and running and registered by your state’s deadline to avoid fines and penalties.

What qualifies as a qualified private retirement plan? It can be complicated and vary from state to state. Basically, the plan you choose must conform to IRS standards. The IRS has some rules about tax deductions that apply to different retirement plan contributions. If your state (or city) requires small businesses to offer a retirement plan to employees and you don’t want to use the state plan, you must find out what your state deems an acceptable alternative. The requirements of each state can be different.

What are the penalties if I do not implement the mandate in time?

As you may guess, each state has different penalties. They range from as low as $20 up to several thousand dollars, and are usually levied per employee, based on the time period you are out of compliance.

If you’re thinking of offering your own qualified private retirement plan as an alternative to your state’s plan, consider working with 401GO. Our clients love how easy it is to get a plan up and running with us, and how affordable each plan is.