If you, like many other business owners, have ever considered offering a 401(k) at your company but hesitated because of cost, it might be the time to reconsider. Thanks to the SECURE Act 2.0, the government is offering major tax credits that can reduce or even eliminate the costs of starting and running a retirement plan for you and your employees.

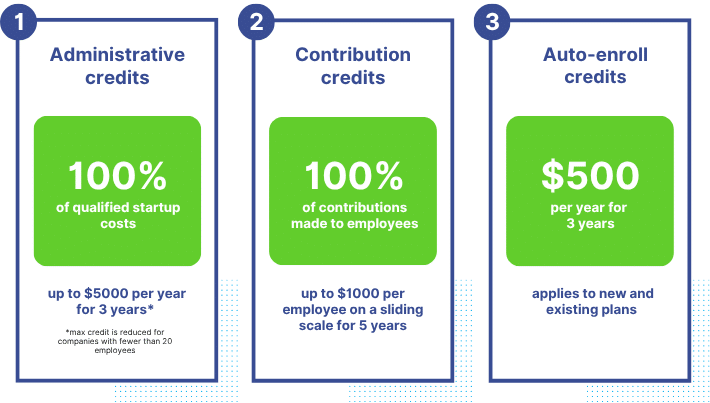

Here are three credits you need to know about.

1. Startup Credit for Plan Costs

One of the main barriers for small businesses to establish a retirement plan has been the upfront cost of setting it up. SECURE 2.0 has addressed that head-on by increasing the startup credit to up to 100% of eligible costs. For businesses with 50 or fewer employees the credit covers the lesser of $250 x the number of eligible non-highly-compensated employees and $5000.

For example, if you spend $4,000 on setup and administrative costs and have 16 employees, you could receive all $4,000 back through a tax credit. Businesses with 51–100 employees are still eligible for a 50% credit.

2. New Credit for Employer Contributions

SECURE 2.0 also introduced a new credit to help cover the cost of employer contributions. This is a big one, as businesses with 50 or fewer employees can get a credit of up to $1,000 per employee, depending on how much you contribute to their accounts. This essentially means that the first $1,000 you match an employee is net-free for the first two years.

Here’s how it phases out over five years:

- Year 1: 100% of contributions (up to $1,000 per employee)

- Year 2: 100%

- Year 3: 75%

- Year 4: 50%

- Year 5: 25%

Even businesses with up to 100 employees can qualify for a partial credit.

3. Bonus Credit for Automatic Enrollment

Plans that use eligible automatic enrollment features (which are required for most new plans anyway) get an extra $500 per year for three years. That’s $1,500 just for encouraging employees to save more easily.

Real-Life Example

Let’s say you own a 10-person company and you’re starting a new 401(k):

- $2,500 startup/admin credit

- $10,000 match credit (10 × $1,000)

- $500 auto-enroll credit

That’s $13,000 in total tax credits available! And you can receive similar benefits for multiple years.

How 401GO Fits In

Even with these tax credits, it is important for business owners to evaluate providers to ensure that the credits can be used effectively. With 401GO’s competitive pricing, businesses are more likely to offset the full cost of a plan, whereas other providers may have higher costs that don’t always get covered.

Beyond price, knowing what you should get in credits at the end of the year can be difficult. 401GO will calculate the amount businesses qualify for and fill out Form 8881, which can be shared with your accountant to file for the credit. (Be sure to check this form with a tax professional before you file.) This is yet another way 401GO looks to make plan sponsors’ lives easier.

The Bottom Line

SECURE 2.0 has made 401(k) plans more feasible than ever. With the right setup, small businesses can now start a 401(k) plan at little to no net cost, and even get rewarded for doing it right.

Beyond the tax savings, a retirement plan can help you recruit top talent, reduce turnover, and support your employees’ long-term financial wellness.

If you’ve been on the fence, this is the year to act.

Need help figuring out how these credits could apply to your business? Let’s talk. There’s never been a better time to offer a 401(k).