As a small business owner, you may be contemplating offering your employees a retirement plan. You undoubtedly know that the most valuable employees wish to work at companies that offer good benefits, and if you don’t have a retirement plan, you may fail to attract the best and brightest. Should you offer your employees a 401(k) plan? Or would a 403(b) work better for your situation? What’s the difference? Read on to find out.

401(k) Plans for Small-Business Owners

When 401(k) plans began replacing pensions in earnest, it was standard to see them only at larger companies — the types of businesses that had the time and money to get a retirement plan off the ground and running. For the most part, small businesses were essentially unable to get into this exclusive club. But now that small-business owners can work with companies such as 401GO, they have the opportunity to quickly and easily start their own 401(k) for employees to participate in.

And whereas it once took weeks of completing paperwork and slogging through other time-consuming steps to get your retirement plan off the ground, with 401GO, you can get going on your 401(k) in a matter of minutes. Our streamlined process makes becoming a 401(k) plan provider easy, fast and affordable for small-business owners.

403(b) Plans for Nonprofits

As attractive as a 401(k) plan with 401GO is for small-business owners, you may instead want to consider a 403(b) plan.

Plan participation in a 403(b) is limited to nonprofit businesses. To qualify as a nonprofit, a company must use any profits it makes to improve the company, rather than to enrich its owners and operators. The legal requirements of becoming a tax-exempt 501(c)(3) company are many and technical, but generally speaking, nonprofits perform some type of service for the community. Common nonprofits include charities, churches, educational institutions and more.

What makes a 403(b) plan different from a 401(k)? When 403(b) plans were first offered, participants could only invest in annuities. The reason for this is that most of these plans were offered by insurance companies. 403(b) plans were considered not ideal, because they were known to be expensive, with high fees going to pay insurance brokers’ commissions.

While 403(b) plans are no longer limited to annuity sales (although participants can still invest in annuities), the good news is that 401GO can provide your nonprofit with a 403(b) plan at no extra cost to you over that of a traditional 401(k) plan.

Additionally, now employees can invest in mutual funds through a 403(b) plan, bringing them more in line with 401(k) plans. However, with a 403(b), participants’ ability to invest in stocks and bonds is still limited.

Why Choose a 403(b)?

Just because you are eligible to offer a 403(b) plan to your employees doesn’t necessarily mean it’s a better choice for your small business than a 401(k). There is a lot to consider.

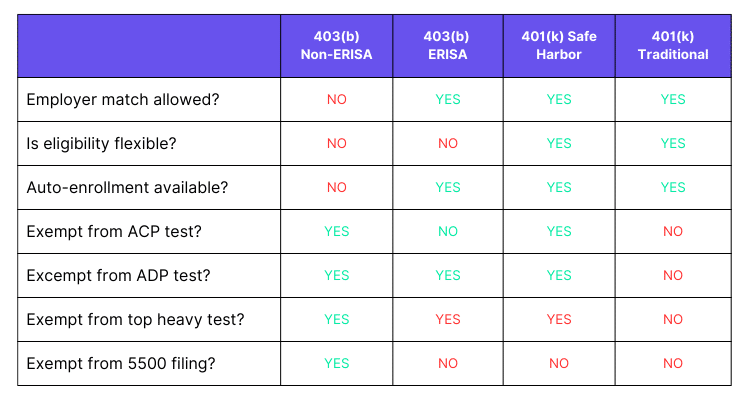

When you look into the advantages and disadvantages of participating in a 403(b), the research is often geared toward the participant rather than the plan sponsor. One specific advantage you would have as a sponsor of a 403(b) plan is exemption from some ERISA (Employee Retirement Income Security Act) laws. These may include regulations around vesting, fees, reporting and more. While ERISA laws are valuable and important in protecting plan participants, the laws fill more than 700 pages, making compliance too onerous and expensive for many small-business owners. Thus, in order to make retirement planning accessible to employees of nonprofits, many are ruled exempt from some of the rules that would be overly burdensome for a small business.

As the owner of a small nonprofit, the savings you can realize not only from working with 401GO, but also in your exemption from ERISA oversight rules and audits, can mean the difference between making a retirement plan an affordable reality at your company and having to forego this valuable benefit.

There are some important aspects of a 403(b) that small nonprofit owners should be aware of, however. The ERISA exemption often doesn’t apply if you provide employer matching contributions to the plan. Additionally, if an employee files a complaint about how you are managing your 403(b) plan, this could trigger an audit, which could cost thousands of dollars. This is the tradeoff for being exempt from some ERISA laws — there must be a vehicle for identifying and correcting mismanagement of funds.

Consider a Safe Harbor 401(k)

403(b) plans have long been considered easy to manage when compared to a traditional 401(k), but the truth is that they are similar to a Safe Harbor 401(k). In fact, many nonprofit businesses prefer a Safe Harbor 401(k) to a 403(b).

401(k) plans offer a lot of plan design flexibility, and the new generation of fintech platforms makes them surprisingly easy to set up and administer. They are exempt from annual testing, and have the same contribution limits as a 403(b).

Employees seem to prefer 401(k) plans, which boast better participation rates and higher savings rates than 403(b)s.

Which Option Is Right for You?

If you’re wondering whether a 401(k) or a 403(b) would be a better choice for your small nonprofit company, talk to your financial advisor. They can go over all the specifics with you, such as whether you would want to use the 403(b) to contribute to your own retirement fund, whether it would make sense for you to offer employees both a 403(b) and a 401(k), what type of vesting schedule would work best for your company, how or if limited investment choices would impact plan participants and other issues.

When you’re ready to get started on your company’s 403(b), call the team here at 401GO. We can help you and your employees prepare for the future.