If you’re a small-business owner thinking of offering a 401(k) plan to your employees, you may want to consider a Safe Harbor plan. Safe Harbor plans have some distinct advantages over traditional 401(k) plans and may be especially attractive to small businesses. 401GO works with small and medium-sized businesses across the U.S. to help them quickly and easily set up 401(k) plans, including Safe Harbor plans.

What Is a Safe Harbor 401(k) Plan?

This may not surprise you, but the IRS has a long list of complicated rules that apply to businesses operating 401(k) programs, and the testing that ensures compliance doesn’t come cheap. Sometimes these regulations are so onerous that they act as a deterrent for businesses interested in starting a 401(k) plan. Small businesses are often treated the same as large companies, but with an unfair disadvantage of fewer employees to balance out a plan. However, in the case of 401(k) plans, small businesses have an alternative: Safe Harbor plans.

A Safe Harbor plan has different rules and affords participating companies certain exemptions that can make this type of plan easier to manage for a small business.

How Is a Safe Harbor Plan Different from a Traditional 401(k)?

When 401(k) plans began replacing pension plans in the 1980s, the burden of funding retirement was shifted from the employer to the employee. While employers still have the role of managing the 401(k) plan, they no longer have to worry about funding a pension plan that hundreds or thousands of employees were counting on in their retirement. Instead, employees now bear the risk of market corrections, inflation and other issues that can impact the purchasing power of their retirement savings.

As a way to help protect employees — especially those at the bottom of the workplace hierarchy — the IRS instituted rules that businesses must follow in order to limit an employer’s ability to funnel most of the benefits to highly compensated employees. In order to ensure these rules are being followed, employers offering a traditional 401(k) plan must conduct yearly nondiscrimination tests. If a business fails this test, it may be required to make restitution, such as contributing more to affected low-level employees’ accounts.

But even those businesses that pass the test must set aside funds to pay for it, and these costs can be prohibitively expensive to small businesses. That’s why Safe Harbor plans are so attractive to small businesses — they are exempt from nondiscrimination tests.

Why Choose a Safe Harbor Plan?

So why wouldn’t every business set up a Safe Harbor plan, you ask? There are many reasons, but one of the main ones is that with a Safe Harbor 401(k) plan, employees are required to be vested right away, rather than over a period of years. Many businesses rely on their vesting schedule to discourage employees from hopping among competitors in the same field, quickly jumping ship for a slightly higher salary or more flexible work schedule. If an employee is close to being vested, they are more likely to stick with a company even when a competitor offers them an attractive package. When you choose a Safe Harbor plan, you have to be comfortable with the employee owning your contributions from the moment you make them.

Additionally, a Safe Harbor plan may end up costing some business owners more than a traditional 401(k). This can happen in the case of employers who want to offer their employees a 401(k) plan, but can’t afford (or don’t want) to make matching contributions on their behalf. If you choose a Safe Harbor plan, you will save by not having to conduct expensive tests, but you will be required to make some contributions on behalf of your employees. You may pay less with a traditional 401(k) that doesn’t require you to make employer contributions.

Safe Harbor plans are essentially broken down into four types:

- Non-elective: With a non-elective plan, employers contribute 3% to all eligible employees’ 401(k) plans, regardless of whether the employee contributes anything themselves.

- Basic: With this plan, employers must only contribute to the accounts of employees who elect to also contribute themselves. Employers must provide a 100% match for employee contributions up to 3% and 50% for the next 2%.

- Enhanced: With an enhanced Safe Harbor plan, the 100% match increases to 4% and can be applied through 6%.

- QACA: With QACA Safe Harbor plan, the first 1% of income an employee contributes is matched at 100%, and the next 5% is matched at 50%. This type of plan requires automatic enrollment, but allows employees to opt out.

The type of Safe Harbor plan you choose for your company will depend on your finances and your preferences for human resource management strategies.

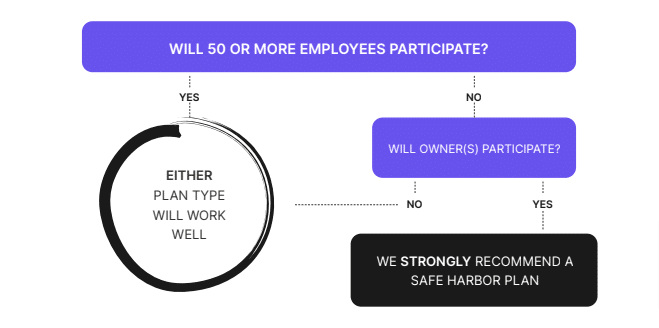

Is a Safe Harbor Plan Right for Your Company?

Safe Harbor plans are a way for small-business owners and all highly compensated employees at the company to be able to contribute to their retirement funds without the worry of passing nondiscrimination testing, but it’s not the only way. If you believe that a Safe Harbor plan would be too expensive for your company, one option is to make 3% employee contributions to traditional 401(k) plans automatic. Although employees have the ability to opt out of this arrangement, doing so is an extra step many will not bother to take. And the more employees you have in the plan, the greater the chance you will pass nondiscrimination testing, because the benefits are spread around more evenly.

It’s not guaranteed, however, and it’s important to weigh all your options and consult with your financial advisor before making a decision about going with a traditional 401(k) or a Safe Harbor plan. Once you’re ready to embark on a retirement saving program at your small business, it’s quick and easy with 401GO.